Construction companies are currently borrowing more than firms in other industries to fund insurance, according to proprietary data from credit insurer, Premium Credit.

The company's latest Insurance Index, published today, found that more than half of SMEs industry-wide are relying on some form of credit to fund cover, with the average firm borrowing around £1,130.

Construction firms accounted for 12% of all net advances from Premium Credit last year. That was unchanged in 2021 and 2020. The provider's fastest growing markets, meanwhile, are the professional and sciences sectors, which accounted for 12% of net advances last year compared with 10% the previous year, and 9% in 2020. Other sectors in Premium Credit's top five were manufacturing, land transport and wholesale and retail trade.

The data also shows that 25% of SMEs have reduced the level of cover they have across a number of lines, with vehicle, property and public and product liability most likely to see reductions in cover. Around a third of SMEs that reduced the level of cover cancelled at least one policy. Up to 10% polled said they plan to increase the level of cover in the year ahead.

Owen Thomas, chief sales officer at Premium Credit, commented: “Insurance is vital for business operations as demonstrated by the near 20% growth in net advances we have seen year on year. It is particularly important in the construction sector which accounts for how much lending we do in the sector.”

Printed Copy:

Would you also like to receive CIR Magazine in print?

Data Use:

We will also send you our free daily email newsletters and other relevant communications, which you can opt out of at any time. Thank you.

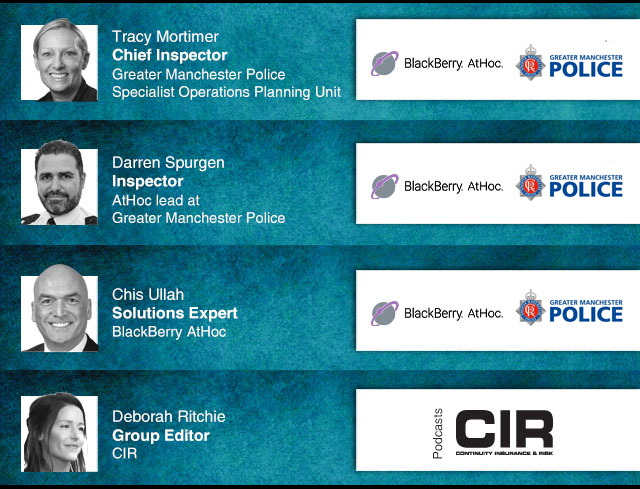

YOU MIGHT ALSO LIKE